If you’ve been following the papers much lately – you know that there are several big hedge funds buying up a lot of the Tampa Bay short sales and foreclosures in our market. I work for one investor who is not a hedge fund, but buys some properties similar to what the hedge funds are buying – single family homes, 3 bed 2 bath or larger, in newer condition in nice neighorhoods that can be rented out for the next 3 to 5 years. In trying to find properties for this investor, I’m often in a race against time and bidding against other Realtors’ buyers to secure these properties for my client.

Myself and some of my Realtor colleagues who also help investors started to notice a trend lately when looking at Fannie Mae Homepath foreclosure listings potentially for our investors. They are all coming on the market at 20-25% higher than the nearest recent comparable sale in the neighborhood. Seems odd, right, since most people think a foreclosure is going to be their best bet for a good deal? Nope, think again.

According to some internet rumors among Realtors, some believe Fannie Mae would prefer to foreclose on homes over accepting a short sale – yikes. That’s because they can put the properties back on the market as an foreclosure listing (aka an REO – real estate owned) listing, and seek a buyer that will use Fannie’s own HomePath financing. With HomePath financing, there is no appraisal, and of course Fannie Mae earns the interest instead of some other private lender. There is also no mortgage insurance required with Homepath. But buyer beware – Homepath also usually comes with a higher interest rate than a standard FHA or conventional mortgage. Thus, Fannie Mae can charge a premium for their REO foreclosure properties when there is no appraisal required.

If you follow, then you realize that these new home buyers are underwater on their new mortgage on the date of the closing if they didn’t check the comps and offered the asking price. In some cases we are seeing buyers that fall in love with a property, and despite their Realtor’s advice, may offer over the asking price. That’s a fine strategy if the home is priced well to begin with, but if its 20% over market value already… well…you see where this is going. There’s also a lot of buzz from Realtors who are working on short sales where Fannie Mae owns the loan, that the BPO values (like an informal appraisal ordered by Fannie Mae) are coming back 20% + higher than neighborhood comps too. This furthers the theory that Fannie might rather foreclose if they can’t get their overinflated dollar figure.

One Realtor who blogged on the topic wrote that he had the opportunity to sit in on a conference call with Fannie Mae representatives and it all became clear as to why their properties in some states like Florida are listed so high. He stated, “The current mission of Fannie Mae is to bring about neighborhood stabilization, and preserve neighborhoods. In conjunction they want to lessen losses; however one cannot be accomplished without the other.” So what does this have to do with overpricing homes in Florida?

“With Fannie being the leader in owning mortgages, chance are that for every one Bank Owned home or Foreclose on a street, they own 10-12 others on the same street. So it is of benefit to both Fannie Mae and the neighborhood for the foreclosure home to be priced higher. The hope is to be less of a shock factor for those other ten – twelve performing notes on the block, so that they keep performing and paying their mortgages. This is a must to bring about stabilization.”

So which is it? Is Fannie Mae just trying to do good for our communities, bringing about market stabilization by over-inflating their asking prices, or are they trying to double-dip and earn interest on Homepath mortgages with no appraisal? Hmm… I hate to be a conspiracy theorist but this does not look good, Fannie. Do they need to take a trip back to 2005-2007 to remember what happened the last time prices were quickly over-inflated?

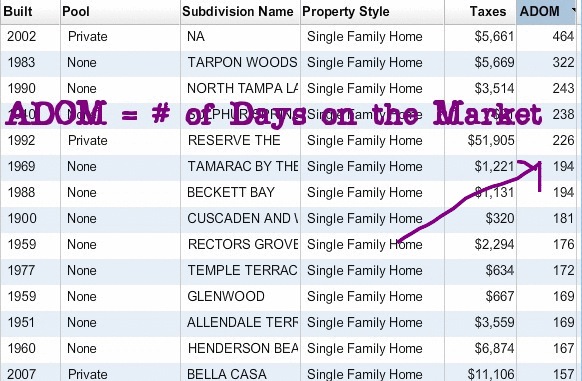

The average days on Market in Tampa Bay is 75 days – and in price ranges under $250,000, it’s even lower due to high demand. Let’s take a look at some Fannie Mae foreclosure listings that I found in the MLS which are, in this Realtor’s opinion, overpriced for the neighborhood. Check out the ADOM which stands for All Days On Market. Much higher than average.

What do you think about what Fannie is doing? In this Realtor’s opinion, if you are a looking for a great deal on a home – make sure you check the comparable sales and don’t just assume that foreclosure listing is a good price. The non-distress sale next door may be a better value!

I am so glad to read this article. I am furious to be seeing this and dealing with it again, so soon after what we just went through. I am a realtor in south florida and the fannie foreclosures that are listed here are way above the last sale price for that neighborhood and the selling realtors are then saying that they will not accept a lower appraisal and are pushing their home path product. But you need a 650 score to get a homepath. I can not believe that banks that own the foreclosures are not accepting the appraised value. Stabilizing neighborhoods – BS! This article is totally correct in stating that the buyers are buying a property that they will be upside down in right off the bat. They are just starting the cycle all over again. Is there any agency that can look into this practice – and quickly???

If you check out Fannie Mae stock prices too, you’ll notice they went from about 90 cents a share to about 2 dollars a share really quickly. Lobbyists are trying to get the government to change their minds about disbanding Fannie and Freddie. I don’t seem them getting disbanded anytime soon the way things are going, and with government officials with Fannie stock, well…. hmm.

I totally agree with you guys. They are doing the same here in Las Vegas, NV. What I noticed is that the normal Joe buyer with a loan cannot compete with the cash buyers offers then Fannie Mae appraises the house way above appraisal. The cash buyers are walking on most of the offers and the homes are going to foreclosure.

Inventory is increasing because of all this but nobody can buy because the homes cannot appraise for what Fannie Mae is asking.