I heard a shocking statistic the other day in a real estate class. 24% of millennials aged 24-32 are still living with their parents. WHAT?! I also heard that a very high number of millennials with baby boomer parents are using their parent’s money to help them buy a home. I guess mom and dad want them out of the house one way or another! 🙂 I got a question on this very subject and thought it might be helpful to those out there who’s family want to financially help them buy a home.

Q: My fiancé and I are both 24 years old and getting married in July, and we’re hoping to buy a house when our lease is up in September. We’ve spent a lot of money on our wedding, but we’re hoping to get at least some of the money back as gifts, and our parents are prepared to gift us money towards a home (yay!) How does that work, can we use gift funds? I heard there are stipulations to using gifted funds, is this true?

A: Yes, it is true. You might think that you can just use whatever gifts your friends and family give you for your down payment, but using gift money is not as cut and dry as you might think. Whether you have $10 or $10,000, the source of the funds in your bank account will matter just as much as how much money you actually have. To understand why, you’ll first need to understand what mortgage underwriting is and how it impacts your mortgage loan.

Underwriting refers to the process in which your mortgage company looks at your credit score, income and assets to determine how risky you are to lend money to. When underwriters look at your assets, they check to make sure that the money in your account is indeed YOUR money – that is, they want to make sure any large deposits in your account are gifts, not loans, from friends and family. They want to ensure that you can really afford your mortgage payments and that you’re likely to pay on time.

So how does an underwriter establish that deposits in your bank account are gifts and not loans? They’ll need the gift-giver to write a gift letter. Let’s take a look at what that means.

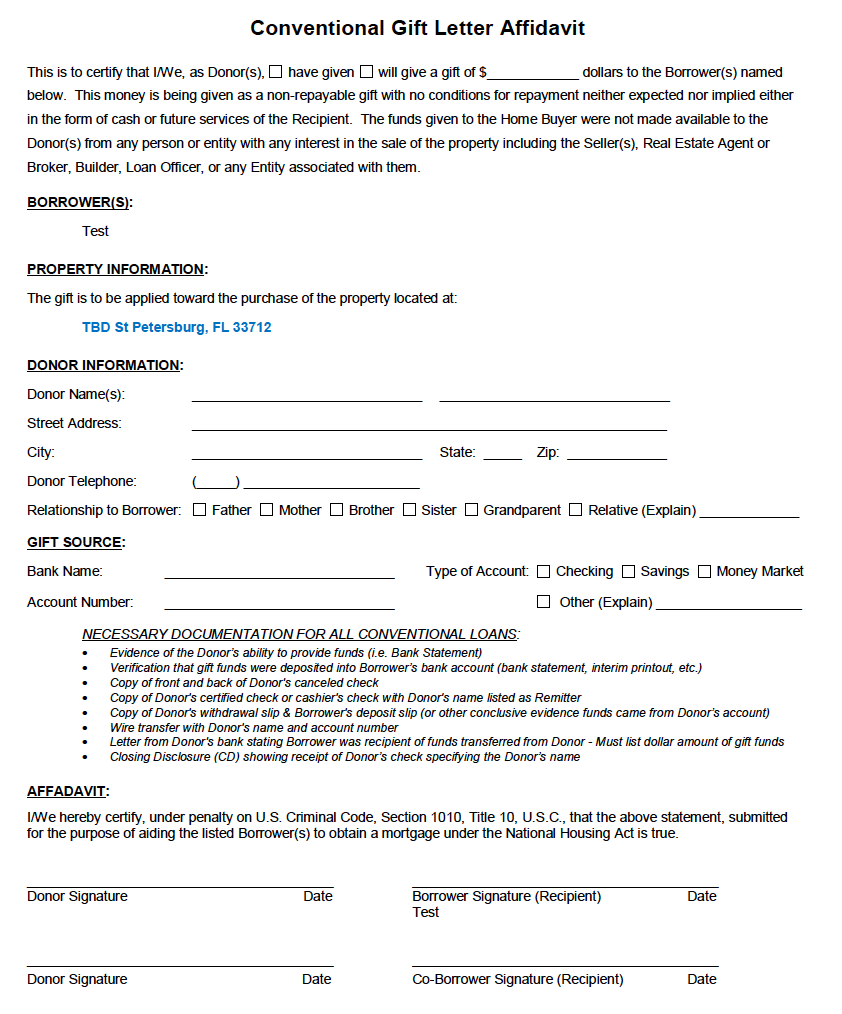

If you’re using gift money as part or all of your down payment, you’ll need the donor to write a gift letter to your mortgage company that makes it clear that the money is a gift and not a loan. Here’s what your gift letter should include:

- The donor’s name, address and phone number

- The donor’s relationship to the client

- The dollar amount of the gift

- The date the funds were transferred

- A statement from the donor that no repayment is expected

- The donor’s signature

- The address of the property being purchased

We have a gift letter form that can be completed by you and the donor that we can give our buyers for this purpose. Here’s an example:

Understand that the gift letter in itself may not be enough evidence for the lender. If you’re getting an FHA mortgage, the donor will be required to provide a bank statement in addition to a gift letter – so you’ll probably want to let your generous donor know this upfront so it’s not a surprise that the lender wants some of their personal info.

The amount of money you put down in relation to the size of the gift may also impact the type of loan you can use.

Conventional

If you put down 20% or more, it can all be from a gift.

If you put down less than 20%, part of the money can be a gift, but part must come from your own funds. This minimum contribution varies by loan type.

You can only use gift money on primary residences and second homes.

FHA and VA

All of your down payment can be gifted funds.

If your credit score is between 580 and 619, at least 3.5% of your down payment must be your own money.

You can only use gift money on primary residences.

Keep in mind that these rules are subject to change based on lending laws – so check with your mortgage company for up-to-date guidelines.

After your wedding when you (hopefully) have checks to deposit, you don’t want those deposits to cause a problem when trying to qualify for your loan. Here’s how to avoid that, from Quicken Loans:

“Many lenders require a 60-day history of assets for qualification purposes. As long as you have documentation for the past 60 days, your mortgage company can take it from there.

So within that 60-day period, which deposits do you have to worry about getting a gift letter for? Grab your wedding veil and jump into this hypothetical situation with me for a moment.

You just got married. Aunt Sue gave you a $75 check, but Grandma Betty gave you $10,000 for tying the knot (you’ve always suspected you were the favorite grandkid). Will you need gift letters for both deposits?

In general, your underwriter will need to verify the source of any large deposit. So what’s the criteria for “large deposit”? “Any single deposit that exceeds 50% of the total monthly qualifying income.” This is for conventional, VA and Jumbo loans. For FHA, the threshold is 25%. Let’s say you are doing a conventional loan for our example. If you make $4,000 a month, any deposit over $2,000 would probably be questioned by your underwriter. Therefore, the underwriter will probably want to verify that Grandma Betty’s $10,000 gift is a gift, not a loan, so you’ll need to ask her for a gift letter. Aunt Sue’s gift, however, is small enough that the underwriter might not question it.

Of course, this is partially up to the underwriter’s discretion. If there are any deposits that seem to be out of the ordinary, your underwriter may question them regardless of your income. Here’s an example: “If a client only maintains a $400 balance on a regular basis, but all of a sudden has a $5,000 deposit, even though that $5,000 may not be over 50% of the total income, it raises a red flag.” So we would dig deeper into that situation, just to make sure the situation checks out. So while your Aunt Sue’s small gift might not be questionable in itself, if the underwriter finds that it’s out of the ordinary, he or she may require gift documentation.”

Do you still have questions about using gift money for your down payment? Speak with your mortgage lender or comment below, and we’ll get you some answers!

Leave a Reply